1.II.28I

Part II, 2006

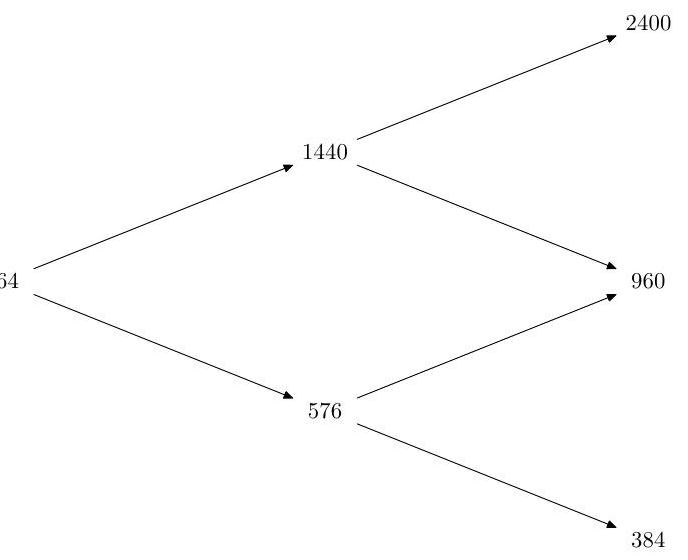

Over two periods a stock price moves on a binomial tree.

Assuming that the riskless rate is constant at , verify that all risk-neutral up-probabilities are given by one value . Find the time- 0 value of the following three put options all struck at , with expiry 2 :

(a) a European put;

(b) an American put;

(c) a European put modified by raising the strike to at time 1 if the stock went down in the first period.